The wearables device market is still HOT

Feb 13, 2014

Wearables Market Heating Up, With More Than 17M Bands Forecast To Ship This Year, Says Canalys

The wearables device market is still in its infancy but it’s growing fast — with more than 17 million wearable bands forecast to ship this year, according to a new forecast by Canalys.

It reckons 2014 will be the year that wearables become a “key consumer technology,” and is predicting the smart band segment alone will reach 8 million annual shipments, growing to more than 23 million units by 2015 and over 45 million by 2017.

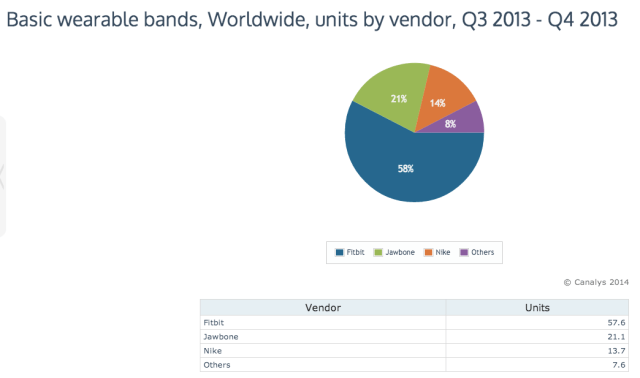

The analyst said shipments of both basic band wearables (aka the Fitbit) and smart band wearables (aka fully fledged smart watches that can run apps) grew dramatically in the second half of last year — with Fitbit pushing into the lead spot in the wearable band market, thanks to the affordable Flex and Force bands.

Fitbit dominated the market for “basic bands,” according to Canalys’ market estimates, with more than 50 percent market share in the second half of the year. The Jawbone UP came second, cutting itself around a fifth of the pie, followed by Nike with its Fuelband.

Meanwhile, at the emerging “smart band” end of the market — where an Apple iWatch would live should Cupertino ever unbox one — Samsung is the earlier leader, with its Galaxy Gear smart watch accounting for the majority of smart band shipments. Sony (actually a relative veteran of the smartwatch space) came second, taking almost a fifth of the market, closely followed by Pebble.

Samsung gained its early lead thanks to a “major marketing push,” said Canalys analyst Chris Jones, but he added that the company is likely to have to keep throwing money at the category to improve sell-through. The Gear did not review terribly well.

“Samsung launched the Galaxy Gear with a major marketing push that gained significant consumer interest. Shipments of the device took Samsung to the top of the smart band category, though disappointing sell-through will necessitate more promotional activity in coming months,” he noted in a statement.

Although basic band wearables have shipped in greater numbers to date than smart bands, having had the launch jump on their fancier rivals, the latter category is already growing faster, according to Canalys.

The analyst said smart bands are also likely to consume the functionality of their more basic category predecessor — which will presumably eat into basic bands’ market share in future, as smart band launches proliferate and shipments continue to grow.

Category convergence is therefore expected, in much the same way that the smartphone gobbled up and extended the basic functionalities of the feature phone. ”Increasingly, smart bands will adopt basic band features as the two categories converge,” added Jones.

As for what wearable bands are for, that’s set to expand, too. Canalys said it sees a huge opportunity for expansion into the medical and wellness segment, moving out from the current focus on a “relatively small market” addressing fitness enthusiasts. That expectation meshes with the rumours around Apple’s health focus for a forthcoming iWatch and iOS 8.

“The wearable band market is really about the consumerization of health,” added Canalys Analyst Daniel Matte in a statement. “There will be exciting innovations that disrupt the medical industry this year, and with the increased awareness about personal wellbeing they will bring to users, having a computer on your wrist will become increasingly common.”

The analyst also expects Google to make changes to Android to improve its suitability for the smart band market. Google acquired smartwatch maker WIMM Labs back in 2012, so presumably has specific designs on the category — beyond letting its Android OEMs build their own wearable band offerings atop its platform.

“Android will be critical for developing the smart band app ecosystem, though significant changes will be required before it is suitable for wearable devices,” added Matte. “Canalys expects Android to enter the smart band market soon in a meaningful way. Battery life and quality of sensor data will be vital metrics of success for all smart bands.”

Source: Techcrunch.com